Bonus depreciation calculation example

Prior to enactment of the TCJA the additional first year depreciation deduction applied only to property where the original use began with the taxpayer. 22 2017 increased the bonus depreciation rate back to 100.

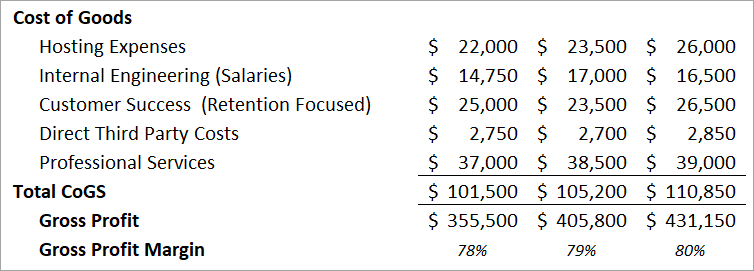

What Should Be Included In Cogs For My Saas Business Saas Capital

2 Financing based on credit approval.

. 16667 13333 30000. 21814 cost basis 90 business use 19633 business portion cost basis. When the bonus depreciation rate reverted to 50 in 2012 Pennsylvania returned to its 37 formula.

19633 - Section 179 Deduction 10000 9633 Adjusted cost basis. It is free to use requires only a minute or two and is relatively accurate. 19633 - Section 179 Deduction 10000 9633 Adjusted cost basis.

Bonus depreciation applies to new equipment only. 9633 - 2890 6743 new cost basis for depreciation calculations for current year and future years. In this module you will take a deeper dive into concepts of cost recovery used in the US.

Bonus depreciation has different meanings to different people. A cost segregation study can be conducted to calculate how much of a newly purchased rental property may be subject to bonus depreciation. Ad Edit Sign Print Fill Online DoL ETA 790 more Subscribe Now.

9633 30 bonus special depreciation allowance 2890 bonus depreciation amount. 100 bonus depreciation allows a real estate investor to deduct the entire cost of some improvements made in 2022. The new law expands the definition of qualified property to.

21814 cost basis 90 business use 19633 business portion cost basis 19633 - Section 179 Deduction 10000 9633 Adjusted cost basis 9633 30 bonus special depreciation allowance. 1 Tax calculation is only an example for illustrative purposes. 9633 - 2890 6743 new cost basis for depreciation calculations for current year and future years.

Most recently the 2017 Tax Cuts Jobs Act TCJA enacted on Dec. Bonus depreciation was increased to 100 by the Tax Cuts and Jobs Act of 2017. All of their depreciation expense in a given tax year because of a federal net operating loss NOL should deduct 16 of the amount added back in the subsequent six years.

Adjusted cost basis - 30 bonus depreciation amount Adjusted cost basis to use for current and future year depreciation calculations. The following bonus depreciations are associated with an asset depreciation book. The Pennsylvania Department of Revenue responded immediately by releasing Corporation Tax Bulletin 2017-02 on the.

In our case we are referring to the bonus depreciation made available by the Tax Cuts and Jobs Act of 2017 and applies to property. Bonus depreciation is a valuable tax-saving tool for businesses. The next bonus depreciation amount for the Liberty Zone depreciation will be.

You can calculate bonus depreciation by using the proposal process or you can create manual bonus depreciation transactions. Not all finance agreements can take advantage of Section 179 tax incentives. The bonus depreciation calculator is on the right side of the page.

Marks annual depreciation deduction. Consult your tax advisor regarding Section 179 and the specific impact on your business. 21814 cost basis 90 business use 19633 business portion cost basis.

There are some restrictions on the type of property that can be depreciated using bonus depreciation. Marks annual depreciation deduction. 33333 26667 60000.

Updated on December 29 2020. Accelerated Depreciation Amortization and Depletion. 30 percent Priority 2.

This deeper dive begins with a discussion about the two different types of additional first year depreciation known as Section 179 depreciation and bonus. 9633 30 bonus special depreciation allowance 2890 bonus depreciation amount. It allows your business to take an immediate first-year deduction on the purchase of eligible business property in addition to other depreciation.

First bonus depreciation is another name for the additional first year depreciation deduction provided by section 168 k.

How To Calculate Total Paid In Capital Accounting And Finance Accounting Books Financial Management

Bonus Depreciation Definition Example How Does It Work

Experience Maximum Tax Savings In 2018 With 100 Bonus Depreciation Shawmut Equipment Crane Sales Rentals Parts Service

Section 179 And Bonus Depreciation In 2013 Blackburn Childers Steagall Cpas

Account Chart In 2022 Bookkeeping Business Small Business Accounting Accounting Education

Macrs Depreciation Calculator With Formula Nerd Counter

Calculate Depreciation In Excel With Sum Of Years Digits Method By Learn Learning Centers Learning Excel

Depreciation Macrs Youtube

Estimating Tax Savings From 100 Bonus Depreciation Semi Retired Md

An Excel Approach To Calculate Depreciation Fm

How To Calculate Depreciation Expense For Business

Depreciating Farm Property With A 15 Year Recovery Period Center For Agricultural Law And Taxation

The Silver Lining To Used Equipment Prices Farming Organic Farm Farmers Farmersmarket Agriculture Ou Successful Farming American Agriculture Agriculture

Bonus Depreciation And The Macrs Youtube

Prime Cost Calculation Great Article On How How Food And Labor Costs Are Calculated Food Cost Restaurant Management Food Truck

Double Declining Balance Depreciation Calculator

Salvage Value Formula Calculator Excel Template